The Limits of a Statutory Court’s Powers

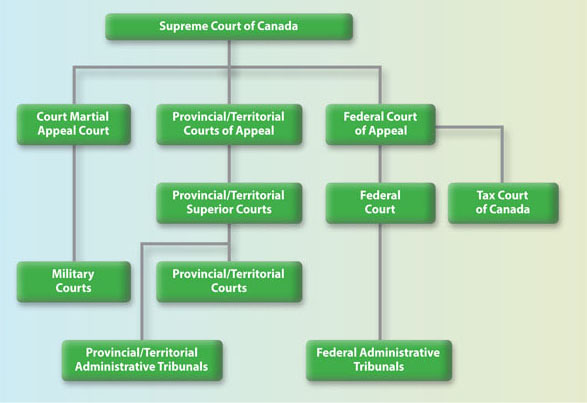

Hot off the email presses, this Federal Court of Appeal case on an assessment by the CRA and the dismissal of the taxpayer’s appeal at the Tax Court of Canada, reinforces that statutory court’s are limited in the relief they can offer taxpayers:

[39] Where an assessment of income tax is appealed to the Tax Court, the only issue before the Tax Court is the validity of the assessment based on the relevant provisions of the Income Tax Act: Main Rehabilitation Co. v. Canada, 2004 FCA 403 at para. 8; Ereiser v. Canada, 2013 FCA 20 at para. 31. It is “clear that the Tax Court of Canada does not have the jurisdiction to cancel an established assessment based on improper conduct by the Minister”

(Robertson v. Canada, 2017 FCA 168 at para. 59) or any other government representative, even if that conduct is proven and might be viewed as “reprehensible conduct…such as abuse of power or unfairness”

: JP Morgan Asset Management (Canada) Inc. v. Canada (National Revenue), 2013 FCA 250 at para. 83, and cases there cited.

This is a harsh fact that I saw play out in a previous tax court visit. The appellant had been assessed and found ineligible for a credited new housing rebate and was found liable for the whole amount plus interest despite the fact that his estranged wife, who was not on the application but was on the title for the property, should be responsible for half the amount since she received half the benefit of the credited amount. The appellant asked the judge to make an order that the wife should have to pay half the amount and the judge, despite feeling empathy for the appellant, was unable to do so because he could find no provision in Part IX of the Excise Tax Act that allowed him to require the CRA to equitably split the tax liability. Perhaps another court would have the authority to require the equitable split of the liability but the Tax Court did not and the taxpayer walked away with no relief.

If you or someone you know is under audit or wishes to appeal an assessment of tax owing, get in touch and a former CRA auditor, appeals or rulings officer will assess your likelihood of a successful appeal and offer to take your case on contingency if they believe the likelihood of winning is high.