Intention Test in respect of the New Residential Rental Property Rebate and when the “Particular Time” is for the purposes of occupancy.

This recent case in respect of the New Residential Rental Property Rebate is an interesting one for two reasons: 1. Justice Bocock accepted a letter from a third party as evidence that the intention test was met despite the lessor only initially giving a six month lease to the lessee. 2. Justice Bocock dismantled the […]

Generate Appeal Letter

Generate Appeal Letter Coming Soon.

Just File The Appeal for Goodness Sake!

In AHMADIYYA ABODE OF PEACE INC. v. The King the question of whether a person can amend a GST/HST return or application that has already been assessed is answered again. Amendments/changes are allowed prior to the assessment but once the assessment has been made and mailed, the only option is to file a Notice of […]

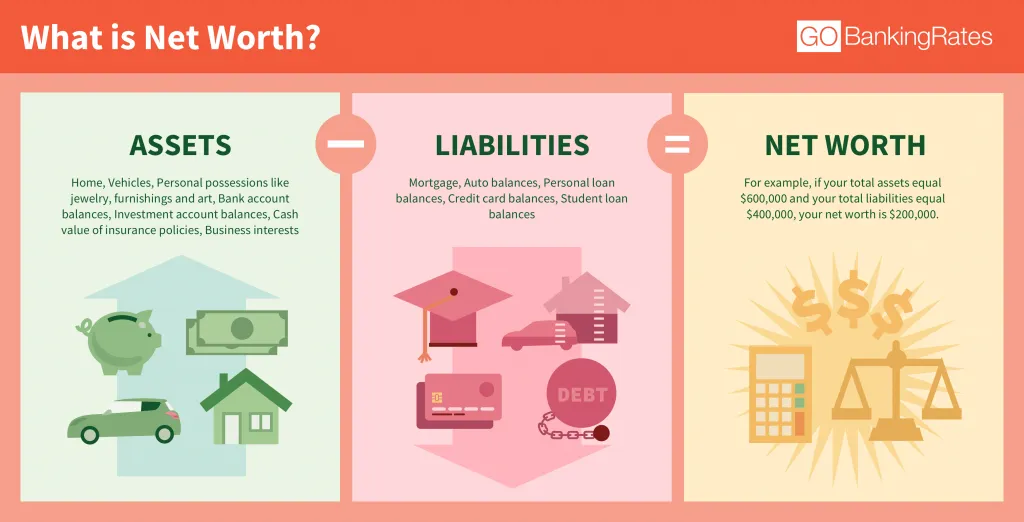

How the Minister discharges the burden of proof onus where a net worth assessment has been used beyond the normal reassessment period.

This recent tax court case explains how the Minister discharges the burden of proof onus when a net worth assessment has been used beyond the normal reassessment period: [32] In addition, in the Lacroix decision, the Federal Court of Appeal dealing with a situation of a reassessment issued beyond the normal reassessment period and where the reassessment was […]

When the circus comes to town

In this recent tax court case the CRA assessed a taxpayer for nearly $250,000 that she claimed should have been accounted for on her husband’s return (no explanation for why this happened). The taxpayer filed their return on time and received a notice of assessment that did not seem to take issue with any part […]

Donative Intent and Charitable Receipts

In this new tax court case Bacchus v. The King, the Appellant (a lawyer and former Dragons Den entrepreneur) claims that he was denied natural justice when he was not interviewed for his “donative intent” at the time CRA disallowed $101,000 in donation tax credits over a number of taxation years. [6] At the commencement […]

Laneway Houses and the New Housing Rebates

Hot off the tax court presses is a new decision on eligibility for the New Housing Rebate for Owner Built Homes. Adjudicated under the informal procedure (non precedent) this decision diverges from the Canada Revenue Agency’s position in an important way. The CRA’s position on the question of whether an Accessory Dwelling Unit (aka, Laneway […]

You Can’t Win if You Don’t Play

This recent tax court case is one that we keep seeing, taxpayers getting assessed and not filing a notice of objection within the statutory time limit or requesting an extension to object. From what I keep hearing, people get into these predicaments for the most part because they believe dealing with it will be too […]

90 Days (+ 1 year in special circumstances) or bust!

This paragraph from the decision to dismiss says it all…. [6] Thus, the affidavit discloses that on December 10, 2021 a notice of objection was served. That date was more than fifteen years beyond the last date (November 22, 2006) for timely serving of a notice of objection and fourteen years beyond the last date (November […]

The limits of a statutory court’s powers

The Limits of a Statutory Court’s Powers Hot off the email presses, this Federal Court of Appeal case on an assessment by the CRA and the dismissal of the taxpayer’s appeal at the Tax Court of Canada, reinforces that statutory court’s are limited in the relief they can offer taxpayers: [39] Where an assessment of income […]